Introduction

Sodium hydrosulfide remains a key chemical in the Asia-Pacific leather industry, mainly used during the dehairing stage of hide processing. In 2026, the market shows stable supply and demand, supported by steady leather production in major countries such as China and India. While growth is moderate, procurement planning continues to focus on reliable sourcing and regulatory compliance.

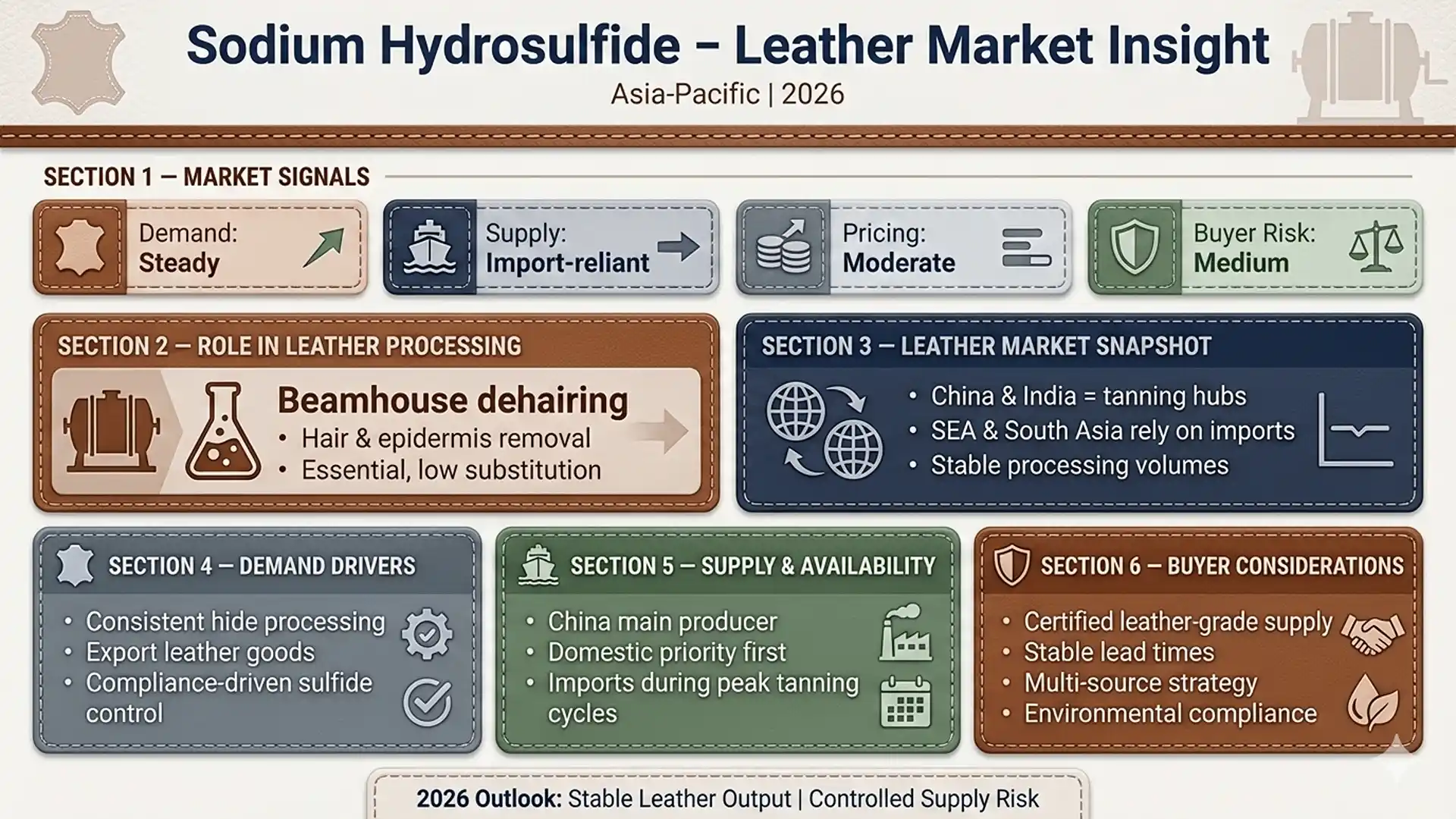

Market Signals for Sodium Hydrosulfide (Asia-Pacific, 2026)

Demand trend: Steady

Demand for sodium hydrosulfide remains consistent as leather tanning volumes hold steady across Asia-Pacific. Global leather market growth of around 1.8% per year through 2033 supports continued use of this chemical, especially in dehairing and unhairing processes at large tanneries.

Supply condition: Import-reliant

Most Asia-Pacific producers supply domestic markets first, leaving leather processors in some countries dependent on imports to meet volume needs. Manufacturing remains concentrated in established chemical hubs, which limits supply flexibility for smaller or emerging leather markets.

Pricing pressure: Moderate

The global sodium hydrosulfide market was valued at about USD 586.8 million in 2025, reflecting stable demand. Prices in Asia-Pacific are expected to remain controlled, though shipping costs, energy prices, and regulatory compliance may cause short-term changes.

Buyer risk level: Medium

Environmental regulations and stricter monitoring of sulfur-based chemicals increase compliance requirements. While the market is mature, buyers remain exposed to supply limits if production disruptions occur in key sourcing regions.

Current Market Snapshot

Sodium hydrosulfide consumption in Asia-Pacific remains closely tied to leather production levels. Major tanning hubs in China and India continue to anchor demand, with imports supporting additional requirements in Southeast and South Asia. Market forecasts show steady growth rather than sharp expansion, allowing buyers to plan procurement with greater confidence.

Price movements remain moderate, reflecting stable use in dehairing applications and limited substitution options. No major supply shocks are expected for 2026, though buyers remain cautious due to the chemical’s regulated nature and transport requirements.

Key Demand Drivers

Growth in leather manufacturing across emerging Asia-Pacific economies continues to support sodium hydrosulfide usage. The chemical is essential for removing hair and epidermis from hides, making it difficult to replace in conventional tanning processes.

Export-driven production of footwear, garments, and leather goods in China and India sustains chemical demand. In addition, stricter wastewater treatment rules encourage controlled use of sodium hydrosulfide for heavy metal precipitation and sulfide management, reinforcing its role in compliant leather processing.

Supply & Availability Signals

China remains the main production base for sodium hydrosulfide in Asia-Pacific, supplying both domestic and regional markets. However, capacity is often balanced against local demand, leading to import dependence during peak periods. Supplementary volumes are sourced from Europe and North America, especially when regional supply tightens.

Logistics routes through major ports remain generally reliable, although congestion and documentation requirements can affect lead times. Environmental regulations on sulfur emissions may also impact production output if enforcement becomes stricter in 2026. Buyers monitor export controls and capacity utilization closely to avoid supply gaps.

Buyer Considerations

Procurement teams should focus on suppliers with strong environmental and safety certifications. Consistent quality and stable lead times are critical due to the chemical’s role in core tanning operations. Multi-source procurement strategies help reduce exposure to supply disruptions and price shifts.

Careful monitoring of shipping schedules, port conditions, and regulatory updates is important for buyers operating in import-reliant markets. Compliance with local chemical handling and storage rules helps prevent delays and operational interruptions.

Leatherchemicalsasia provides market insight and sourcing support, helping buyers secure reliable sodium hydrosulfide supply across Asia-Pacific.for leather needs

Conclusion

The sodium hydrosulfide market in Asia-Pacific is expected to remain stable in 2026, supported by steady leather production and limited substitution in dehairing processes. While supply is generally sufficient, import reliance and regulatory oversight require careful sourcing strategies. Buyers that plan ahead, diversify suppliers, and work with experienced partners will be better positioned to manage risk, control costs, and maintain smooth leather processing operations.

Leave a Comment