Introduction

Potassium dichromate remains an important chemical for chrome tanning in the Asia-Pacific leather industry. In 2026, market conditions reflect stable leather production, steady chemical demand, and rising attention to safety and environmental rules. Procurement decisions are increasingly shaped by supply reliability, hazardous material handling, and regulatory pressure rather than rapid volume growth.

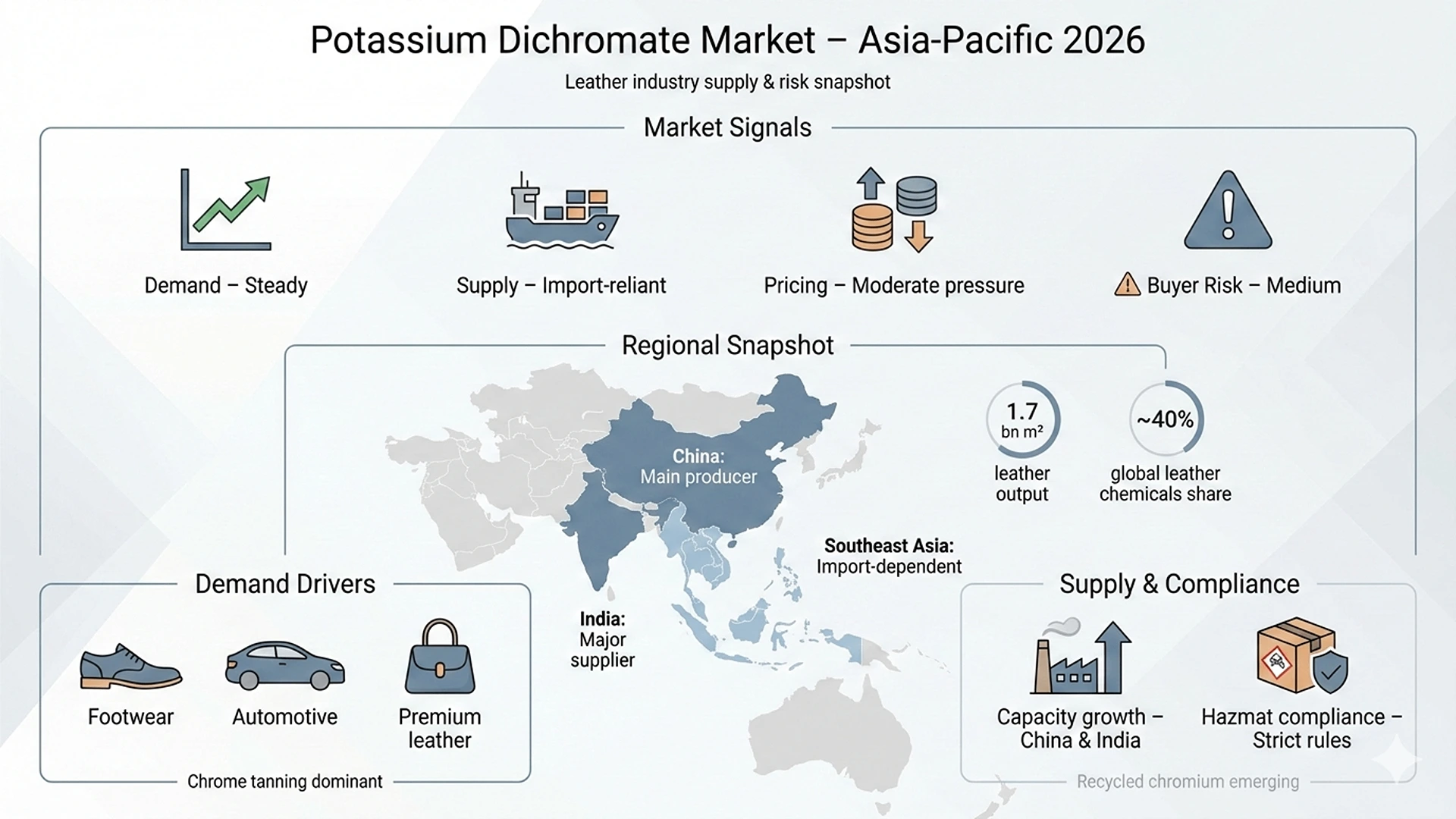

Market Signals – Potassium Dichromate (Asia-Pacific, 2026)

Demand trend: Steady

Leather consumption across Asia-Pacific reached about 2.5 billion square meters in 2024. Long-term forecasts point to slow but positive growth of around 1.0% per year through 2035. This supports ongoing demand for chrome tanning agents, even as some markets begin exploring lower-chrome or chrome-free options.

Supply condition: Import-reliant

China and India remain the main production hubs for potassium dichromate and related chromium chemicals. Despite this capacity, many leather-producing countries in Southeast and South Asia still rely on imports. China continues to export chrome tanning chemicals to countries such as Vietnam and Pakistan to support their tanning industries.

Pricing pressure: Moderate

The global potassium dichromate market was valued at around USD 64.5 million in 2024 and is expected to grow steadily toward 2031. Balanced capacity growth in Asia-Pacific has helped prevent sharp price swings, even as demand from footwear and upholstery remains stable.

Buyer risk level: Medium

Potassium dichromate is classified as a hazardous oxidizing material. Strict transport rules and growing environmental controls increase compliance costs for buyers. New chrome-related regulations, especially those influenced by EU standards, add pressure on tanners to manage sourcing carefully.

Current Market Snapshot

Asia-Pacific leather production stood at roughly 1.7 billion square meters in 2024, staying relatively flat compared with previous years. China remains the largest producer, accounting for about 43% of total output. The region is still a net importer of finished leather, highlighting continued dependence on imported chemicals for tanning and finishing processes.

Pricing conditions remain balanced. New capacity in China and India has helped meet demand from footwear, automotive upholstery, and furniture segments. In 2024, the leather chemicals market in Asia-Pacific reached about USD 4.27 billion, with chrome-based products continuing to hold a major share. Overall, the market favors stable procurement planning, with close attention to regulatory changes.

Key Demand Drivers

Chrome tanning remains the dominant tanning method in Asia-Pacific due to its efficiency, cost advantage, and leather quality. The region accounts for over 40% of global leather chemical consumption, driven mainly by footwear manufacturing and automotive interiors.

Growing demand for premium leather products in fashion and vehicles supports continued use of potassium dichromate and related chrome agents. India recorded about 5% growth in tanning activity in 2023, while Southeast Asia added new chromate-related capacity in 2024. China remains the largest consumer, supported by strong export-oriented leather production and established tanning infrastructure.

Supply & Availability Signals

Most potassium dichromate production in Asia-Pacific is concentrated in China and India. Between 2022 and 2025, the region added an estimated 50,000 tons of chromate capacity, including cleaner production methods introduced in China. These investments help stabilize supply for downstream leather users.

However, many tanneries still depend on imports for specific grades. Cross-border trade requires strict compliance with hazardous material rules, including UN-approved packaging and dangerous goods documentation. Recycled chromium is gaining attention and now covers a small but growing share of consumption, helping ease supply pressure and reduce environmental impact.

Buyer Considerations

For procurement teams, supplier reliability and regulatory compliance are critical. Potassium dichromate handling requires experience with Class 5.1 oxidizers, proper labeling, and transport approvals. Lead times can vary depending on origin and shipping routes, making forward planning important.

Environmental regulations continue to tighten. New limits on chromium exposure and waste discharge push buyers toward cleaner grades and better process control. Many tanneries are now diversifying sourcing between China and India to reduce risk and maintain supply continuity. Working with partners familiar with IMDG and IATA requirements helps avoid shipment delays and compliance issues.

Conclusion

The potassium dichromate market in Asia-Pacific is expected to remain stable in 2026. Demand from the leather industry continues at a steady pace, supported by footwear, automotive, and premium leather applications. While supply capacity is sufficient, import reliance and strict hazardous material rules increase sourcing complexity. Buyers who focus on compliant suppliers, diversified sourcing, and long-term planning will be better positioned to manage costs, meet regulations, and maintain smooth leather production in the year ahead.

Leave a Comment