Introduction

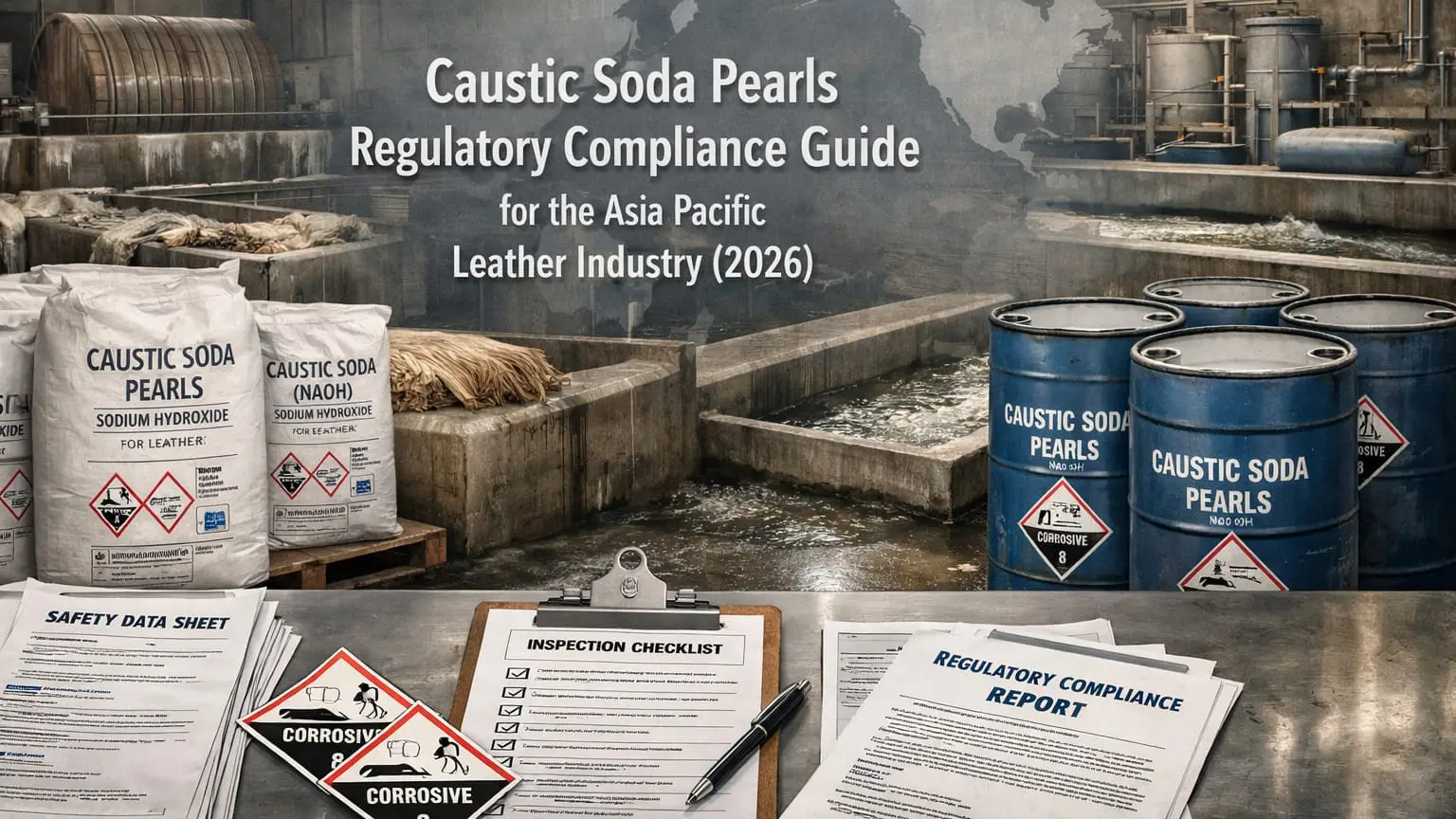

Caustic soda pearls, the solid form of sodium hydroxide, are widely used in leather processing for dehairing, liming, and pH control. In the Asia Pacific region, their use is closely regulated because of strong corrosive properties and environmental risks. By 2026, companies involved in importing, distributing, or using caustic soda pearls must meet stricter safety, environmental, and trade rules to avoid delays, penalties, and supply disruptions.

Understanding these regulations is essential for leather manufacturers and procurement teams operating across multiple Asia Pacific markets.

Why Caustic Soda Pearls Are Strictly Regulated

Caustic soda pearls are highly corrosive and can cause severe burns if they come into contact with skin or eyes. During leather processing, improper handling or spills can put workers at serious risk. Regulators therefore focus on workplace safety and proper training when approving industrial use.

Environmental concerns also play a major role. Wastewater from tanneries that contains untreated sodium hydroxide can damage rivers, soil, and nearby farmland. High alkalinity disrupts ecosystems and affects water quality. Because of these risks, governments enforce strict controls on disposal, effluent treatment, and storage practices.

Key Regulatory Authorities Across Asia Pacific

Each country in the region manages caustic soda regulation through its own chemical and environmental agencies. In China, the Ministry of Ecology and Environment oversees chemical registrations, environmental impact controls, and inventory compliance through systems such as IECSC.

India regulates caustic soda quality and imports through the Bureau of Indian Standards, with specifications under IS 252:2013. Environmental oversight for tannery operations falls under pollution control authorities. In Indonesia, the Ministry of Environment and Forestry supervises hazardous waste management for chemicals used in leather production. Australia and other developed markets rely on national chemical inventory systems to track approved substances and industrial use.

Chemical Registration and Approval Requirements

Caustic soda pearls are generally listed on existing chemical inventories in most Asia Pacific countries. However, importers must still confirm listing status before shipment. In China, IECSC confirmation is required, while in India, BIS certification is often necessary for customs clearance and market acceptance.

High-volume imports or changes in application may require additional approvals. Accurate declaration under the correct HS code for caustic soda pearls is essential to prevent customs delays. Failure to meet registration or certification requirements can lead to shipment rejection or legal action.

Safety Data Sheet and Labeling Obligations

All Asia Pacific markets apply GHS-based rules for Safety Data Sheets and labeling. Caustic soda pearls must be clearly labeled with corrosive hazard symbols, warning statements, and safe handling instructions.

Safety Data Sheets must follow the latest GHS revisions adopted by each country and be written in the local language where required. These documents should clearly explain first-aid measures, spill response, storage conditions, and disposal methods. Regular updates are necessary to remain compliant with changing national standards.

Import, Trade, and Customs Controls

Importing caustic soda pearls requires careful preparation of documents, including SDS, certificates of analysis, and origin certificates. Some countries apply anti-dumping duties depending on the source country, which can affect landed cost.

Customs authorities in India, Indonesia, and other Asia Pacific markets closely inspect hazardous chemical shipments. Incorrect HS codes, missing permits, or outdated SDS documents are common reasons for shipment delays. Leather manufacturers must also ensure that imported material meets purity standards to avoid downstream processing issues.

Storage, Handling, and Transport Requirements

Caustic soda pearls are classified as corrosive dangerous goods and must be stored in sealed, corrosion-resistant containers. Storage areas should be dry, well ventilated, and clearly marked to prevent accidental contact. Contact with acids must be avoided to reduce reaction risks.

During transport, international dangerous goods regulations apply. Packaging must meet approved standards, and transport documents must clearly state hazard classifications. Workers involved in loading, unloading, and handling should be trained in spill response and emergency procedures to meet regulatory expectations.

Common Compliance Challenges in the Leather Industry

One major challenge is managing different GHS versions across Asia Pacific countries. Labels and SDS accepted in one market may not meet requirements in another, causing delays. Certification processes, such as BIS marking in India or inventory checks in China, can extend procurement timelines.

Leather producers also face higher scrutiny on wastewater discharge and hazardous waste classification. Errors in documentation, storage practices, or transport labeling often result in fines or shipment holds, especially for companies handling large volumes.

Best Practices for Regulatory Compliance in 2026

Businesses can reduce compliance risks by confirming chemical inventory status early and working with suppliers who understand regional regulations. Updating SDS and labels regularly to match national GHS revisions is essential.

Using experienced local agents helps with permits, audits, and regulatory communication. Regular staff training improves safety and reduces workplace incidents. Audits of storage and transport systems further support compliance and protect long-term operations.

Conclusion

Caustic soda pearls remain a critical input for the leather industry, but regulatory control across Asia Pacific continues to tighten. Compliance in 2026 will depend on strong documentation, safe handling practices, and awareness of country-specific rules.

Companies that invest early in regulatory planning benefit from smoother imports, lower risk of penalties, and more stable supply chains. As environmental enforcement and GHS alignment increase across the region, proactive compliance will be key to sustainable leather production and long-term market access.

Leave a Comment